There are quite a few reasons why, in the current context, one might want to sell the digital asset known as XRP, one of the top digital currencies in terms of market capitalization (XRP occupies, at the time of writing, the 6th spot) .

But before we dive into the heart of today’s topic, let us briefly define XRP, the digital asset. This definition will provide an entry point into the reasons why it could be a good idea to sell XRP - perhaps to buy lower at a later time.

In the last part of this article, we will provide a practical example that our readers can follow step by step in order to sell XRP.

What is XRP?

XRP, which should be distinguished from Ripple the Company, is one of the oldest cryptocurrencies on the market. This digital asset, launched in 2012, runs on the XRP Ledger, a network which is the brainchild of Jed McCaleb, Arthur Britto and current Ripple CTO David Schwartz.

XRP distinguishes itself from other cryptocurrencies with fast settlements (4 to 5 second settlement time, compared to the minutes or hours it takes the bitcoin network to finalize transactions) and low fees (0.0001 XRP per transaction).

XRP, designed to facilitate cross-border payments, is used by a strong network of large corporations and financial institutions. The crypto community has been asking and screaming for adoption - however in this corner of the Blockchain industry, adoption is a tangible reality. Santander, Axis (News - Alert) Bank and Yes Bank and many others are part of a very wide consortium of institutions that leverage this digital asset and demonstrate the strength of institutional adoption around this digital asset.

At this point of the article, I know which question you might be asking yourself.

XRP seems to have everything going for it as a digital asset: low fees, fast transaction times and institutional adoption.

Why then would one want to sell XRP, the currency?

This is an excellent question, and one that deserves a detailed answer.

- XRP is a pre-mined currency and the supply (1 billion XRP) is quite large, compared to other digital assets (bitcoin for example). While most of that pre-mined XRP is currently in escrow, there is a clear and always present danger for investors as large amounts taken from that escrow can get injected into the markets at very inopportune times. Ripple the company is known to sell XRP to finance its operations, something that has angered the community in the past. However it is worth noting that Ripple is orders of magnitude more transparent than it was regarding those XRP sales.

- Litigation: it is no secret that the SEC (News - Alert) has filed a lawsuit against Ripple, the company, claiming that it should have registered XRP as a security. Seeing this lawsuit unfold in real time and both parties defend their claims is a thing of wonder. This legal black swan has become a huge headache for retail investors and institutions, since it introduces a level of uncertainty in the markets that is difficult to mitigate. How to trade an asset issued by a company that is being sued by the SEC? Is it even a good idea to stay in this market? Should one countertrade the crowd and stay in the market and wait for the SEC “settlement pump”? At the moment, there are no right or wrong answers to these questions - the context surrounding the status of XRP is so nebulous that the best approach perhaps might be to stay on the sidelines and do absolutely nothing until the smoke clears. As a result of this lawsuit, several very large exchanges, such as Coinbase, will not allow XRP to be traded - certain exchanges went as far as delisting XRP, perhaps fearing legal action and reputational damage.

How to go About Selling XRP on an Exchange?

In the above section, we have defined XRP the digital asset and we have covered the reasons why it might be a good idea to get out of the XRP market.

But how does one go about selling XRP?

The thing that will complicate a trader’s quest to sell XRP is that, due to ongoing litigation against Ripple, XRP is not available in many exchanges in the United States. If you are located outside of the United States, the situation might be a little different. XRP-friendly Japan, for example, has never suspended XRP trading and there are even new avenues listing XRP as tradable assets, such as Tao Tao, a Japanese exchange which listed XRP on the 22nd of September.

There are a few things to consider before you even consider logging in and pushing the “sell” button:

Trading Fees: This is a big one. Most centralized exchanges, which is exactly where you want to be since they are the only ones who carry XRP as a tradable asset (we have yet to see native XRP - not wrapped or synthetic XRP - listed on a Decentralized exchange), adopt the maker-taker model.

Traders can be divided into two groups: makers of liquidity and takers of liquidity. You, as an XRP trader looking to sell your XRP on the market, are a taker of liquidity. The fees exchanges charge to takers of liquidity are higher than those charged to makers. You will need to keep a close eye on maker-taker fees and choose the exchange that charges fees you find reasonable.

Certain exchanges, such as Binance, have a table of fees that is directly linked to your trading volume. The more you trade and the lower your fees are. If you intend to sell a lot of XRP, then it would make sense to take advantage of this fee regime.

Withdrawal Fees: One of the things you really need to keep an eye on as a trader are the withdrawal fees. Selling XRP at a fantastic price - and turning in a big profit - only to be charged withdrawal fees so high that they eat into your profits is not something that is desirable. Therefore, you will need to choose an exchange which is known for its low withdrawal fees.

Transaction limits: If you wish to sell XRP in large quantities, you will need to find an exchange that allows you to do so. And how about the amount that you can withdraw? Are there limits placed on accounts daily, weekly? These are things to consider when shopping for the best exchange on which to sell your XRP.

Customer Support: We certainly do not wish that to anyone, but the possibility of a trade going wrong, for technical reasons, is never zero. And therefore, while it is an excellent idea to choose an exchange based on parameters such as transaction fees, withdrawals fees and limits, you should also consider the quality of customer service. If something goes horribly wrong (during a Black Swan event for example, when everyone is trying to get out of their positions at the same time), you need the guarantee that you will be able to write or speak to someone, and get a timely response.

A Practical Example: Selling XRP on Timex.Io

The remainder of this article will be dedicated to the provision of a practical example. Here, we will show our readers exactly how to sell XRP.

For the sake of simplicity, we will focus on a single exchange, Timex.io. However the steps described here can be applied to any other exchange, the only condition being that these exchanges carry XRP as a tradable asset.

What is Timex.io? The platform describes itself as a hybrid cryptocurrency exchange based on Plasma technology. Timex.io trades are settled on the Ethereum Network, however order matching is conducted in a centralized fashion. Basically, Timex.io offers the best of both worlds, as it offers real-time execution while providing mitigation solutions against front-running and order collisions.

The first thing that we will ask of our readers is to go over to Timex.io.

Of particular interest to us is this page, which will allow us to sell our crypto and find out xrp price aud.

Two types of orders are available on Timex.io: Market orders and Limit orders. It is possible to sell XRP for Australian dollars, US dollars and other cryptocurrencies.

For the sake of this example, we have created an account. Let’s log in and see what lies beyond the front page.

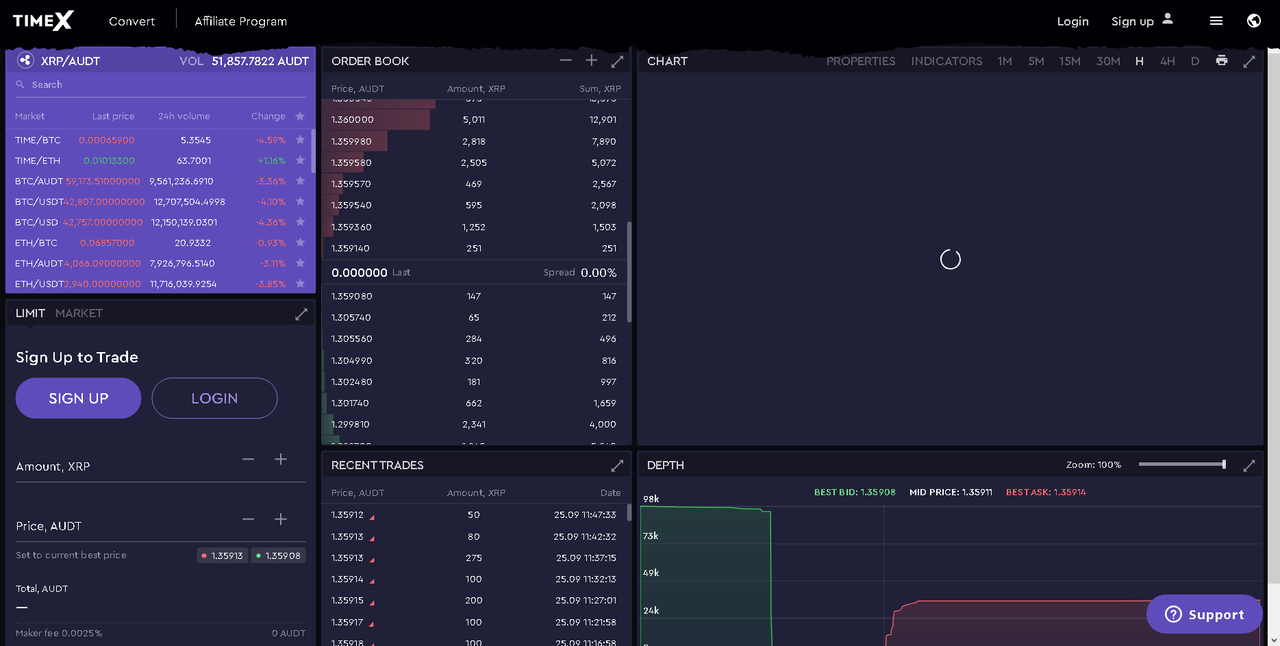

As we log in we are treated to a beautiful, minimal user interface (see below). Two trading modes are available for users: basic and advanced.

The Basic mode will vaguely remind users of Uniswap’s interface. All that is required of users to execute a trade is to enter the origin currency (here, it would be XRP, since this is the currency we are trying to sell), the destination currency, and the amount. To sell our XRP, we would simply choose XRP from the drop down menu, input an amount, and choose a destination currency.

Clicking on the Advanced button at the lower left of the screen opens up a fully-fledged trading dashboard, with charts and a graphical view of the order book.

Sophisticated users might prefer this mode over the basic view. The section of the screen that is of interest to us is the lower left part. In order to sell XRP, users will be required to enter the amount of XRP they wish to sell, the price per XRP (there is a very convenient option to set the price to the current best price) and then click the big red Sell Button.

The user interface, in both basic and advanced modes, is very clean and shines in terms of user experience as the disposition of elements in the graphical space contributes to the reduction of human errors in the trading process (for example, the buy button is a big green element on the page).

Parting Words

As we have seen above, there are quite a few reasons why one might want to sell XRP and rebalance into other cryptocurrencies. The most obvious reason is the ongoing litigation by the SEC which casts a cloud of uncertainty on both Ripple, the company, and XRP, the digital asset.

Selling XRP, as we have seen in our practical example, is definitely not rocket science (and it should never be). For the sake of simplicity, we have used Timex.io to illustrate the steps one needs to take to sell XRP, however these steps can easily be applied to any other exchange.

Happy Trading, and stay safe in the markets!